Update: Terrific news came recently. As part of the recent spending package signed on Dec. 28, 2020, the Solar ITC federal tax credit stepdown has been delayed until 2023. That means all applicable solar systems installed in 2021 and 2022 will receive a 26% tax credit, instead of dropping down to 22%. The drop in credit to 22% is currently scheduled for 2023.

US Federal Solar Investment Tax Credit

The US Federal Solar Investment Tax Credit (commonly known as the Solar ITC) will step down to a new, lower rate on January 1, 2021.

- After starting out in 2006 as a 30% tax credit, in 2020 we saw the Solar ITC step down for the first time – from 30% to 26%

- We will see another Solar ITC step down for 2021 – from 26% to 22%

- If Congress doesn’t extend this program, the Solar ITC will step down to 10% for commercial and utility scale projects – and to 0% for residential systems

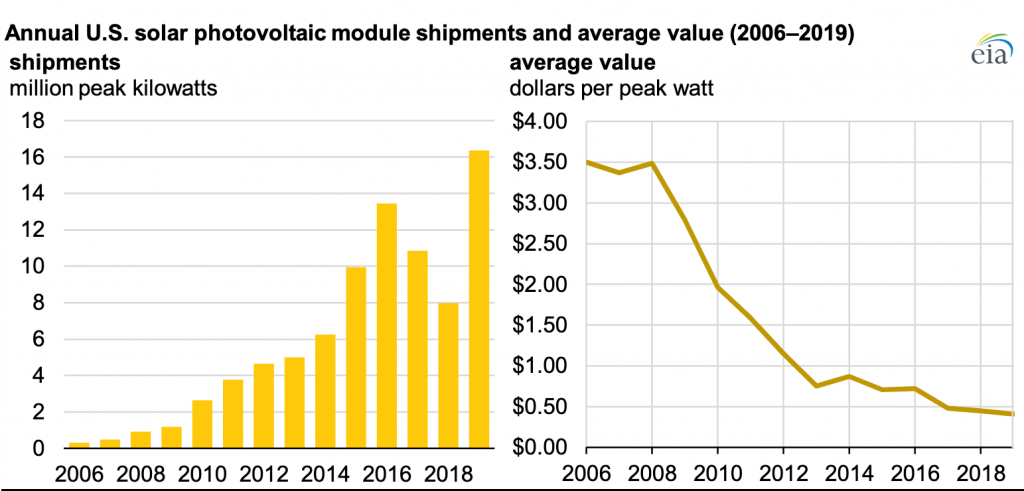

The federal solar tax credit was always intended to gradually decrease as the industry grew and solar panel prices dropped, making grid-tied solar affordable compared to buying electricity from the grid. Both these things have happened, with the solar industry growing an annual average of 52% and solar panel prices falling to just 15% of what they were back in 2006 when the Solar ITC launched.

As Solar Panel Prices Drop, Solar Industry Jobs Grow

Since the beginning of the Solar ITC in 2006, the US solar industry has created hundreds of thousands of good jobs inside the country. As the price of solar decreased, “grid parity” was reached – the point at which it became as cheap – or cheaper – to generate electricity with solar power as it is with fossil fuels. Billions of dollars have been spent on solar in the US, reducing our carbon footprint from power generation while boosting the economy. It’s been a win/win situation.

You Can Still Get the Federal Solar Tax Credit for 2020

A residential solar power system must be put into commission in the year the tax credit is for. So if you want to get the Solar ITC at 26% before it steps down to 22%, you need to have your system up and running by the end of 2020. Systems installed in 2021 will get the 22% credit. Note that the tax credit goes to the owner of the solar system, meaning that homeowners who choose to lease a system will not get the tax credit – the leasing company will.

If you’ve been thinking about going solar, now really is the time. Grab your electric bill, then go to our quote request page or give the altE Store a call to discuss your options at 877-878-4060.

Pingback: The 2021 Federal Solar Tax Credit Step Down | Solaris National

Pingback: The 2021 Federal Solar Tax Credit Step Down - Solar Life

Pingback: The 2021 Federal Solar Tax Credit Step Down - BostonHiTech.com - Latest Technology News

Pingback: The 2021 Federal Solar Tax Credit Step Down – surviveurself