Renewable Energy, Solar Energy Incentives & Rebates, Solar Facts & Figures, Solar Industry News, Solar Panels, Solar Power

The 30% Federal Tax Credit, the solar Investment Tax Credit (ITC), is scheduled to retire on December 31, 2016, dropping commercial incentives to 10%, and residential to zero. The ITC was first enacted as part of the Energy Policy Act of 2005. It was signed by President George W. Bush as an attempt to combat growing energy problems. The Emergency Economic Stabilization Act of 2008 removed some caps and extended it to the end of 2016. The American Recovery and Reinvestment Act in 2009 eliminated the cap on Solar Hot Water. The act changed US energy policy by providing tax incentives and loan guarantees for energy production of various types.

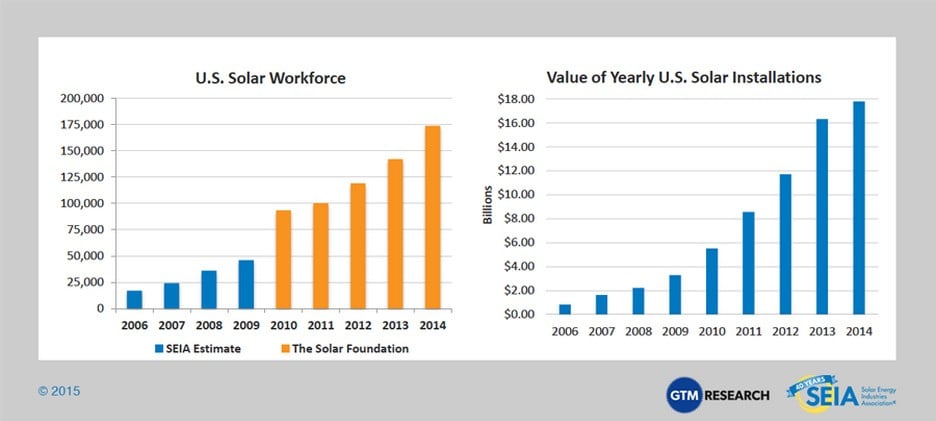

According to SEIA (Solar Energy Industry Association), there are currently 174,000 people employed in the solar industry, in all 50 states, and the majority of jobs are at small to mid-sized companies. Solar installations have grown 3,000% since the ITC started in 2006. During that time, the price for installing a residential solar system has dropped by 73% since 2006, with 45% of it being since 2010. When I first started at altE Store in 2007, installed prices were about $9-10 a watt. Depending on your location, current rates are about $3-4 a watt. This was the intention of the incentives – help to get the volume up, so that the prices can drop. It’s working.

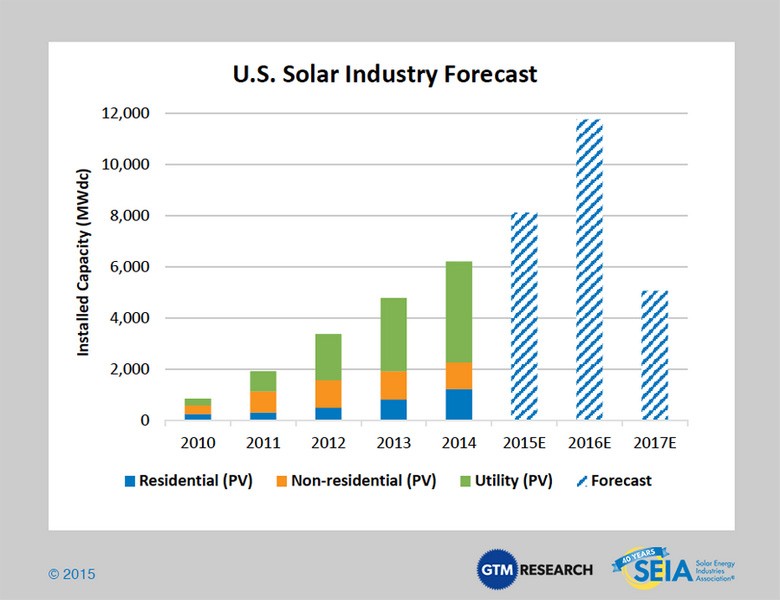

Without the extension of the Solar ITC, new installations are predicted to drop by 57% in 2017. Just for a reference point, when the Wind PTC (Production Tax Credit) expired in 2013, new wind installations dropped 93% and 30,000 jobs were lost. In the 1980s when President Ronald Reagan let the solar tax credits initiated by President Jimmy Carter lapse, and cut the R&D budget for solar by 90%, the newly burgeoning US solar industry crashed, allowing Europe and Asia to dramatically surpass the US product development and solar installations. Within 2 years, over 90% of solar jobs were gone in the US. The US market only rebounded with the 2006 solar ITC. That gave the rest of the world a 25 year head start over the US.

The dramatic loss of the incentive, rather than a gradual reduction, as well as the uncertainty, has the potential to result in the significant loss of good, decent-wage jobs across the country.

In President Barack Obama’s recent 2016 budget proposal, he requested a permanent extension of the ITC, and an increase in Renewable Energy and Energy Efficiency investment. His proposal calls for paying for the incentives by removing tax preferences for the fossil fuel industry. Support for solar has come from both extremes of the political spectrum. Members of the Tea Party support solar, as it provides freedom and independence from utility companies and reduces dependence on foreign energy. They have successfully fought against anti-solar rules in Georgia and are currently fighting in other states, including Florida (the Sunshine State), Indiana, and Texas. The Liberals love the cleaner energy that solar provides. The Department of Defence has a goal to have 25% of their power from renewable energy. Mainstream America is pro-solar, the majority of residential solar installations are on middle-class houses, saving on monthly electric bills. A recent Gallop poll asking Americans: Do you think that as a country, the United States should put more emphasis, less emphasis, or about the same emphasis as it does now on producing domestic energy from each of the following sources? Solar: 79% said more emphasis, 12% same, and only 9% said less. Of the people who responded “More Emphasis,” 70% were the Republicans, 83% were Independents, and 82% were Democrats. Support for more emphasis of solar was up 3% from the same poll in 2013, whereas it dropped for all other sources: Wind (-1%), Natural gas (-10%), Oil (-5), Nuclear (-2%), and Coal (-3).

Unfortunately, many House Republicans have been vocal in their opposition to renewable energy subsidies. The official GOP response to the 2016 budget proposal called his clean energy section “Out of Touch Spending Priorities. American families are concerned about growing our economy and creating jobs — yet the President throws $11 billion towards energy projects, including $7.4 billion to fund clean energy technologies.” Guess what? This proposal does exactly that – it strengthens the economy and creates jobs. With the state of politics today, getting an extension of the ITC may be a difficult task.

California Rep. Mike Thompson (D, CA-5) has filed (H.R. 2412) to extend the ITC another five years. You can ask your Congressperson to support the legislation by clicking here.

Meanwhile, local incentives are still available from states, municipalities, and utilities. To see if any additional incentives are available, go to www.dsireusa.org.